The basic concepts of Hedging, Financial Instruments and Natural Hedge

- Haim Ratzabi

- Oct 16, 2022

- 4 min read

Hedging is an important part of doing business in the international world. In general companies want to decrease exposure to risks of market fluctuations such as foreign exchange rates, interest rates, commodity prices (oil, gas and so on) and equity prices.

For example: companies with large fleets (such as cargo, logistic, transportation, aviation) are exposed to the petrol prices, exposure to variable interest and exchange rate movements related to loans, global companies which operate in many regions and many currencies.

For most of the international businesses, hedging is related to foreign exchange as it is by far the largest market in the world, dwarfing the size of stock and bond markets.

What is a hedge?

A hedging is making an investment or acquiring some derivative or non-derivative instruments in order to offset potential losses (or gains) that may be incurred on some items as a result of particular risk.

Businesses take steps to try to offset the possible losses that may be incurred by investments or by changes in financial markets. Simply you can think about that like buying insurance (like health or life insurance) to cover bad events in markets. From a cash perspective you are paying a small “premium” for buying a financial instrument contract but avoiding a large potential cash loss in the future.

The basic concepts / logic of hedging strategy?

As there is no simple answer to what is the best way to mitigate your potential market risks and there are too many variables and strategies, I will focus on the basic concepts / logic:

1. Using Financial Instruments (for example Forward, Futures) to hedge the risk .

Taylor made hedging built specifically for a specific deal. Usually it is relevant to large PO’s with long payment terms or hedging the risk of change in interest rate, exchange rate, energy and oil prices etc. The hedging instruments must be connected to the underlying assets/ liability otherwise it will be considered as a speculative move.

Most common is the use of forwards or futures to hedge risks. More complex strategies are available too but, from accounting, perspective it could be considered as speculative (axotic) instruments and will hit the P&L.

How much will it cost? What is the right strategy?

As there is no simple answer to those questions and there are just too many variables, I will not expand on this, as if so it will be too long writing…..

I can say that setting a fixed price with a bank at which to exchange currency does not generally have an upfront cost. However, you will need to have an account with the bank already to avoid having to put up collateral (such as a deposit) to be able to receive the deal in the first place. The bank needs to know you can pay.

2. Natural Hedge - this strategy is intuitive and is relatively easy to implement, therefore must be considered in building the right financing structure in a multinational company. (I will expand on that below)

What is a Natural Hedge?

A natural hedge is a management strategy that seeks to mitigate risk by investing in assets whose performance is negatively correlated. It can also incur expenses in the same currency that their revenues are generated thereby reducing exchange rate risk.

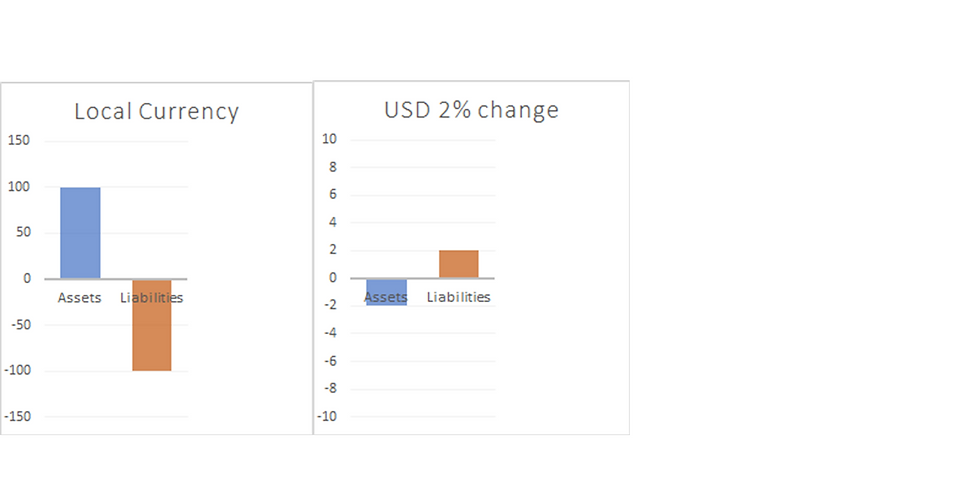

For example, a decrease of 2% in the exchange rate, will decrease the asset USD value by 2% (Loss of 2%) but will decrease the liability as well by 2% (Gain of 2%) - it will be a “zero sum game”.

Understanding Natural Hedges - examples

A company with significant sales in one country is exposed to currency risk when they want to repatriate that revenue. They can reduce this risk if they can shift operations to where they can incur expenses also in that foreign currency, which would qualify as a natural hedge.

An oil producer with refining operations in the US is (partially) naturally hedged against the cost of crude oil, which is denominated in U.S. dollars.

Natural hedges also occur when a business's structure protects it from exchange rate movements. For example, when suppliers, production, and customers are all operating in the same currency, large companies may look to source raw materials, components, and other production inputs in the final consumer's country. The business can then set costs and prices in the same currency.

What is so intuitive in this strategy?

Unlike other conventional hedging methods, a natural hedge does not require the use of sophisticated financial products such as forwards or derivatives. That said, companies can still use financial instruments such as futures, to supplement their natural hedges. For example, a commodity company could shift as much of their operations to the country where they plan to sell their product, which is a natural hedge against currency risk, then use futures contracts to lock in the price to sell (revenue) that product at a later date.

Most hedges (natural or otherwise) are imperfect, and usually do not eliminate risk completely, but, they are still deployed and are considered to be successful if they can reduce a vast portion of potential risk.

…...and one last word about Hedging accounting

The accounting perspective of hedging is very complex and detailed in IAS 39, IFRS 9. If you want to learn about hedge accounting and the cash flow hedging or fair value hedging you should read the following links : Hedge Accounting: IAS 39 vs. IFRS 9, Difference Between Fair Value Hedge and Cash Flow Hedge

Source:

The business of hedging - by Catherine Snowdon BBC Business reporter: https://bbc.in/3kVcAhp

Natural Hedge - by AKHILESH GANTI : https://bit.ly/335KBFW

Picture: INDEPENDENT

Comments